Listen to the article

Market researcher TrendForce announced on Monday a significant upward revision to its chip price forecasts, predicting that conventional DRAM contract prices will surge by 90 percent to 95 percent during the first quarter of 2026 compared to the final quarter of 2025. The dramatic increase in DRAM price forecasts reflects intensifying supply constraints driven by ongoing artificial intelligence development and deployment across the technology sector.

The new projection marks a substantial change from TrendForce’s previous estimate, which anticipated DRAM prices would grow by 55 percent to 60 percent during the January to March period. The research firm attributed the upward revision to persistent demand from AI applications and data center expansions that continue to strain global memory chip supplies.

AI Boom Drives Memory Chip Demand

According to TrendForce’s statement, the relentless demand for memory chips from artificial intelligence and data center operations during the first quarter of 2026 is exacerbating the existing imbalance between global memory supply and available capacity. This supply-demand gap has strengthened the pricing power of memory manufacturers, allowing them to command higher prices for their products.

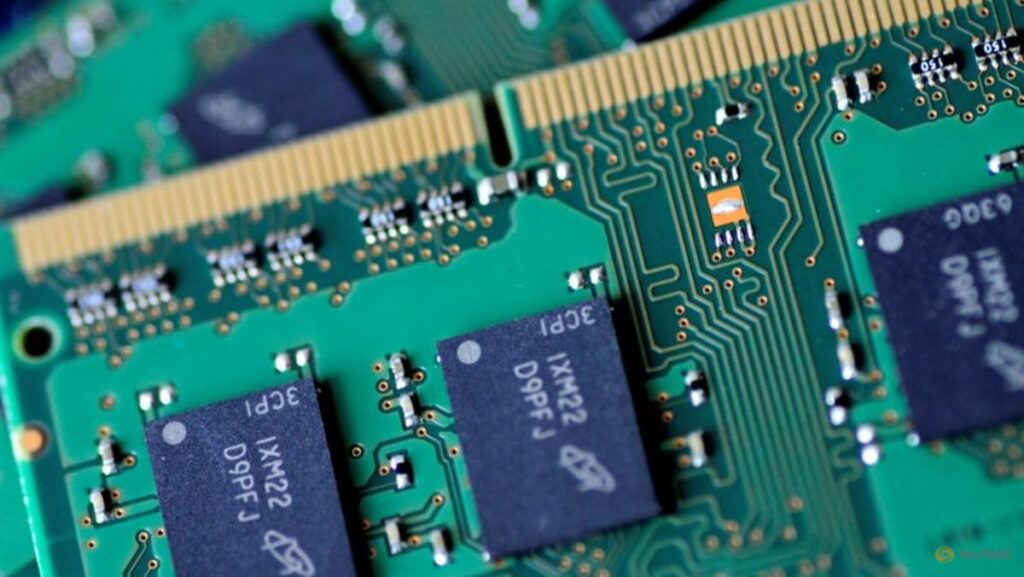

Dynamic random access memory chips serve as critical components in computing systems, storing data that processors need for immediate access. The AI industry’s explosive growth has created unprecedented demand for these chips, as machine learning models and AI applications require substantial memory resources to function effectively.

Supply Constraints and Market Dynamics

The widening gap between memory chip supply and demand has created favorable conditions for manufacturers to increase prices substantially. However, the semiconductor industry has faced challenges in rapidly expanding production capacity to meet the surge in orders from technology companies investing heavily in AI infrastructure.

Additionally, data center operators have been competing aggressively to secure memory chip supplies as they build out facilities to support cloud computing services and AI workloads. This competition among buyers has further contributed to upward pressure on DRAM prices throughout the supply chain.

Industry Implications and Market Impact

The steep rise in DRAM prices could have significant implications for technology companies that rely on these components for their products and services. Manufacturers of servers, personal computers, and other computing devices may face increased production costs, which could potentially affect profit margins or lead to higher prices for end consumers.

Meanwhile, major memory chip manufacturers stand to benefit from the improved pricing environment. Companies such as Samsung Electronics, SK Hynix, and Micron Technology have experienced increased revenue potential as memory prices have climbed in recent quarters alongside growing AI-related demand.

In contrast to previous industry downturns that saw oversupply and falling prices, the current market cycle has been characterized by tight supply conditions. The shift reflects the fundamental changes in computing architecture required to support artificial intelligence applications, which typically demand more memory capacity than traditional workloads.

Industry analysts note that the memory chip sector’s fortunes have improved dramatically compared to conditions in recent years when excess inventory and weak demand pressured manufacturers. The AI boom has transformed market dynamics, creating sustained demand that has allowed suppliers to implement significant price increases.

TrendForce has not indicated when it expects the supply-demand imbalance to ease or whether DRAM prices will continue rising beyond the first quarter. Market observers will be monitoring whether chip manufacturers can increase production capacity sufficiently to meet ongoing AI-driven demand in subsequent quarters of 2026.