Listen to the article

Indonesia’s inflation rate surged to 3.55 percent in January, marking the fastest pace in nearly three years, according to the country’s statistics bureau. The reading came in slightly above Bank Indonesia’s target range of 1.5 to 3.5 percent and exceeded the rate of 2.92 percent recorded in December, though it remained below analyst expectations of 3.78 percent.

The January inflation data was released alongside unexpectedly strong trade figures for December, which showed robust export and import growth despite analyst predictions of declines. Statistics Indonesia announced the figures on Monday, providing insight into the economic health of Southeast Asia’s largest economy.

Understanding Indonesia’s Inflation Surge

A senior official at Statistics Indonesia, Ateng Hartono, attributed the relatively high inflation reading to a low base effect. According to Hartono, the government had provided electricity tariff discounts to some customers in early 2024 to support economic growth, creating a comparison challenge for year-over-year calculations.

The official expressed confidence that the inflation rate would normalize by March or April, provided no additional government policies affect pricing. Additionally, the annual core inflation rate, which excludes government-controlled prices and volatile food costs, increased to 2.45 percent in January from 2.38 percent in December.

Impact on Monetary Policy

Indonesia’s inflation has remained within or below Bank Indonesia’s preferred range since mid-2023, enabling the central bank to implement a rate-cutting cycle. Between September 2024 and September 2025, the monetary authority reduced rates by a cumulative 150 basis points to stimulate economic activity.

However, the January inflation spike may prompt the central bank to reassess its policy stance in the coming months. The reading marked the highest level since May 2023, according to LSEG Refinitiv data, potentially complicating future monetary policy decisions.

Strong Trade Performance Defies Expectations

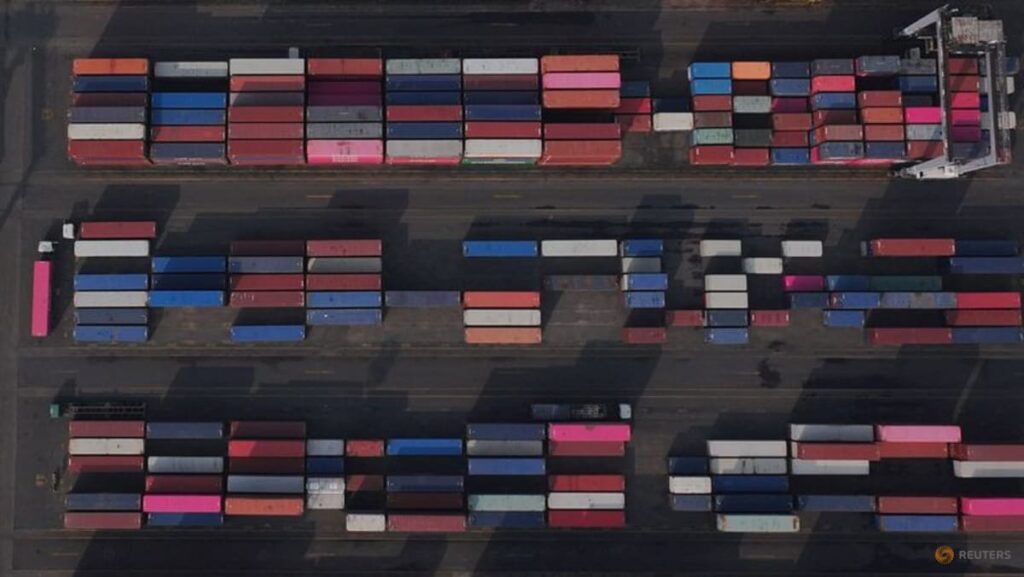

Meanwhile, Indonesia’s December trade data revealed significant strength across both exports and imports. Exports surged 11.64 percent year-over-year to $26.35 billion, far exceeding analyst forecasts of a 2.40 percent decline, the statistics bureau reported.

The export growth was driven primarily by increased shipments of palm oil, nickel, semiconductors, and other electronic components. In contrast to expectations, imports also climbed 10.81 percent from the previous year to $23.83 billion, whereas analysts had anticipated a 0.7 percent drop.

Trade Surplus Strengthens

The resource-rich nation recorded a trade surplus of $2.52 billion in December, slightly surpassing the forecast of $2.45 billion. For the full year of 2024, Indonesia posted a total trade surplus of $41.05 billion, representing a substantial increase from $31.33 billion in 2023.

Additionally, Indonesia’s trade surplus with the United States expanded to $18.11 billion in 2024 from $14.52 billion the previous year, despite tariffs implemented under President Donald Trump’s administration. The country’s surplus with the European Union also grew to $6.98 billion from $4.43 billion, as Indonesia prepares to finalize a trade agreement with the bloc.

Market observers will monitor upcoming inflation readings in the next two to three months to determine whether the January spike represents a temporary anomaly or signals a more persistent trend. The central bank has not yet indicated any immediate changes to its current monetary policy stance in response to the latest data.