Listen to the article

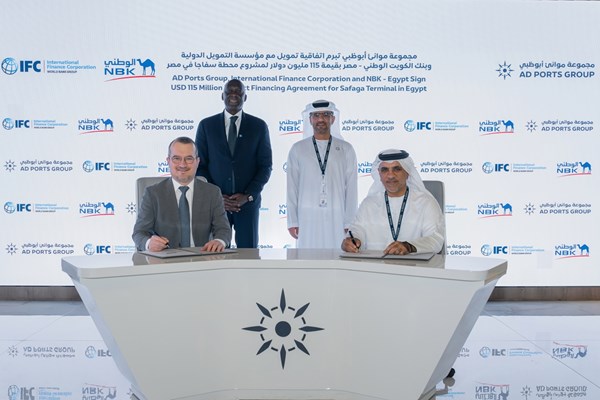

Abu Dhabi Ports Group has successfully secured a $115 million financing agreement to support development activities at Noatum Safaga Terminal in Egypt. The port financing deal underscores the company’s long-term commitment to expanding critical port infrastructure and enhancing logistics services across key international markets. The agreement received backing from the International Finance Corporation, National Bank of Kuwait-Egypt, and other investment institutions through a joint lending portfolio managed by IFC.

The financing arrangement features a 15-year maturity period, reflecting strong international confidence in Abu Dhabi Ports Group’s operational capabilities and Egypt’s strategic role within global supply chains. According to company officials, the financing has obtained all required approvals, with financial closure expected during the first quarter of 2026, subject to fulfillment of customary precedent conditions.

Strategic Approach to Port Financing

The financing agreement aligns with the group’s strategic direction to leverage long-term funding supported by multilateral institutions. This approach facilitates execution of strategic long-term infrastructure projects in rapidly growing markets. Additionally, the deal demonstrates the company’s disciplined methodology for financing infrastructure projects through partnerships with multilateral organizations and global investment institutions.

Captain Mohamed Juma Al Shamisi, Managing Director and Group CEO of Abu Dhabi Ports Group, stated that the IFC-backed financing deal reflects their disciplined approach to funding long-term infrastructure projects in fast-growing markets. He emphasized that participation by IFC, National Bank of Kuwait-Egypt, and other international investment institutions supporting the Noatum Safaga Terminal development project demonstrates their growing and established presence in Egypt.

International Collaboration and Economic Impact

Mokhtar Diop, Managing Director of the International Finance Corporation, indicated that enhancing trade serves as a fundamental element in stimulating economic development. The transaction reflects IFC’s role as a strategic enabler for South-South investments, according to the official. Meanwhile, the project will contribute to strengthening Egypt’s position as a pivotal trade hub, reducing costs for local companies, and creating high-value job opportunities.

Yasser El Tayeb, Vice Chairman and CEO of National Bank of Kuwait-Egypt, described the financing as embodying their commitment to supporting strategic infrastructure projects that drive sustainable economic growth. He noted that collaboration with IFC and Abu Dhabi Ports Group reflects confidence in Egypt’s logistics sector and its promising long-term prospects. Furthermore, the project aims to achieve positive environmental impact through carbon dioxide emissions reduction.

Comprehensive Investment Portfolio in Egypt

The Noatum Safaga Terminal project carries an estimated value of approximately $200 million. Located on Egypt’s Red Sea coast, it represents the first international maritime terminal in the Upper Egypt region. The project forms part of the group’s comprehensive strategy to develop and operate high-performance terminals and ports along rapidly growing trade corridors.

Abu Dhabi Ports Group’s investments in Egypt encompass container shipping activities, terminal operations, cargo handling, maritime agency services, and freight transportation. The group also operates cruise ship terminals in Red Sea ports, specifically in Safaga, Hurghada, and Sharm El-Sheikh. In 2025, the company expanded its investment portfolio by signing a renewable 50-year usufruct agreement to develop and operate KEZAD East Port Said, an industrial and logistics zone spanning 20 square kilometers along the Mediterranean coast at the entrance to the Suez Canal.

Growing Presence in Mediterranean Markets

To solidify its position as a leading trade facilitator across the Mediterranean and Red Sea regions, the group acquired a 19.328% ownership stake in Alexandria Container and Cargo Handling Company, one of Egypt’s largest container terminal operators. Recently, the company announced its intention to launch a mandatory tender offer to acquire an additional stake, which would grant majority controlling interest. In contrast to its Red Sea operations, this Mediterranean acquisition would enhance the group’s expansion in Egypt and generate tangible financial returns through operation of two strategic terminals at Alexandria and Dekheila ports.

Financial closure for the Safaga terminal financing remains contingent upon satisfaction of standard conditions precedent, with completion anticipated in early 2026. Authorities have not confirmed specific timelines beyond the first quarter target, though all regulatory approvals are reportedly in place.